Managing IP, 25 March 2013

Prudence Jahja and Andrew Diamond explain the IP challenges facing Indonesia as it prepares to join the ASEAN Economic Community.

One Minute Read

ASEAN member states are set to form the ASEAN Economic Community, a single harmonised market similar to the EU, in 2015. Members of this new union must modernise their IP regimes to comply with specific targets, including accession to the Madrid Protocol and the PCT.

Indonesia, however, faces a number of challenges. It must make both substantive legal changes (including strengthening protection for well-known marks and recognising three-dimensional and sounds marks), as well improve administrative procedures. But with no trade mark legislation on the agenda for 2013, it is unclear whether Indonesia and other ASEAN countries will be able to make all the necessary changes by the December 31 2015 deadline.

The 10 member states of the Association of Southeast Asian Nations (ASEAN) have all committed to transform their economies into a single harmonised market similar to the European Union by the end of 2015. As part of this commitment to the new ASEAN Economic Community (AEC), members must meet targets set out in the ASEAN Intellectual Property Rights Action Plan 2011-2015.

While acknowledging that some members may move at “varying paces”, the Action Plan’s five strategic goals and corresponding initiatives and deliverables have nonetheless set member states on a scramble to revise their IP statutes, accede to the relevant treaties and generally make progress in meeting the agreed-upon goals. Indonesia’s attempts are drawing particular interest, and are illustrative of some of the challenges in strengthening IP in the region.

The Plan

The AEC is designed to encourage “the free movement of goods, services, investment, skilled labour and freer flow of capital” in the ASEAN region. Included in this commitment are pledges from ASEAN member states to enact a broad range of initiatives set out in the ASEAN Intellectual Property Rights Action Plan 2011-2015 that not only promote the use of IP “as a powerful tool for development” and further economic integration among member states but also seek to “ensure the protection and enforcement of IPRs of trading partners”.

Indonesia is ASEAN’s largest economy and most populous country. A darling of investors yet a frequent visitor on the USTR’s Priority Watch List for IPR violations, Indonesia has often been viewed as a challenging IP jurisdiction that follows its own rules despite ostensibly being a member of the global IP community. In spite of this widespread view, Indonesia is also ASEAN’s most active trade mark and patent jurisdiction on a volume basis. While some progress has been made, much remains to be accomplished, promising that the next few years will see substantial changes to the way intellectual property is created, registered, administered, protected and enforced in Indonesia.

Indonesia’s trade mark regime – a system unto itself

Among all the branches of intellectual property addressed by the Action Plan, it is the trade mark field that poses the most significant challenge to Indonesia. The Action Plan calls for the implementation of a number of trade mark-specific provisions, such as reducing the time from filing to grant to six months, capacity building for trade mark professionals and examiners, and implementing a Regional Classification of Ethnic Goods and Services. But it is the requirement in Strategic Goal 2 for all ASEAN member states to accede to the Madrid Protocol by 2015 that constitutes the biggest hurdle for Indonesia.

The challenges posed by Indonesia’s accession to the Madrid Protocol are not so much from the Protocol itself, though they are certainly present, but more from the looming spectre of comprehensive linkage with the global trade mark system. Despite its accession to the Paris Convention in December 1950 and the TRIPs Agreement in January 1995, as well as corresponding revisions to its trade mark law in 1961, 1992, 1997 and 2001, Indonesia has remained a somewhat idiosyncratic and closed-off trade mark jurisdiction. Applications are still submitted manually in the Indonesian language, while statutory gaps in procedural and substantive areas of the trade mark law have led to inconsistent decisions from both the Trademark Office and the courts, generating an overarching level of uncertainty. As such, accession to the Madrid Protocol – and by virtue, more complete integration with the global trade mark infrastructure – poses both significant administrative and legal challenges for Indonesia.

Administrative challenges

The administrative structures needed for Madrid Protocol accession pose a particular challenge for the Indonesian Trademark Office. Some of the requirements include electronically linking the Trademark Office with WIPO, the ability to accept and process applications in English, and to be prepared to handle an influx of applications from foreign applicants without the use of an Indonesian proxy. These are some of the areas that the Trademark Office has to address before it can administratively handle Madrid applications. It does not have an online filing system, thus requiring all applications to be submitted manually and it requires all applications be submitted in Indonesian. Also, the Office already handles a substantial volume of applications before the expected influx of foreign applications. There has been some progress in this area, however. The Indonesian IP Office (DGIP) recently implemented WIPO’s Industrial Property Automation System (IPAS), which should allow for the electronic filing of applications as well as generally increase efficiency through automated application processing.

A reduction of the turnaround time through electronic filing and increased efficiency would be most welcome, as it now takes between 18 and 24 months to register a trade mark in Indonesia even in the best-case scenarios. Indonesia is by far the most active trade mark jurisdiction in south-east Asia on a volume basis, with 53,196 trade mark applications (including renewals) filed in 2011, the most recent year for which statistics are available (Thailand was second with about 39,000 applications). These numbers are fuelled by an incredibly robust domestic market for trade marks, with over 90% of those applications filed by Indonesian entities. While this has resulted in an unfortunately high rate of trade mark squatting, the more pertinent implication for accession to Madrid is that the Indonesian Trademark Office is faced with a substantial backlog, estimated to have been as high as 143,000 applications by the end of 2009. More recent statistics are not available, though this is likely still a serious issue.

The Action Plan’s five strategic goals

The following is an excerpt from the ASEAN Intellectual Property Rights Action Plan outlining its goals for 2011-2015:

The [ASEAN Working Group on Intellectual Property Cooperation] has formulated the following five strategic goals that will serve as a framework for its work in the next five years. The implementation of the activities and the achievement of deliverables identified under each of the five strategic goals will be monitored and regularly evaluated according to measurable performance indicators that will be agreed among [member states].

Strategic Goal 1:

A balanced IP system that takes into account the varying levels of development of Member States and differences in institutional capacity of national IP Offices to enable them to deliver timely, quality, and accessible IP services to promote the region as being conducive to the needs of users and generators of IP.

Strategic Goal 2:

Developed national or regional legal and policy infrastructures that address evolving demands of the IP landscape and [member states] participate in global IP systems at the appropriate time.

Strategic Goal 3:

The interests of the region are advanced through systematic promotion for IP creation, awareness, and utilization to ensure that IP becomes a tool for innovation and development; support for the transfer of technology to promote access to knowledge; and with considerations for the preservation and protection of indigenous products and services and the works of their creative peoples in the region.

Strategic Goal 4:

Active regional participation in the international IP community and with closer relationships with dialogue partners and institutions to develop the capacity of Member States and to address the needs of stakeholders in the region.

Strategic Goal 5:

Intensified cooperation among [member states] and increased level of collaboration among them to enhance human and institutional capacity of IP Offices in the region.

Legal changes needed

Beyond these administrative challenges, there are also a number of legal hurdles that must be addressed as Indonesia prepares for Madrid Protocol accession. Indeed, there are a number of provisions in the Trademark Law No. 15/2001 that directly contradict Indonesia’s global IP obligations on a variety of topics. With the expected rise of foreign registrations through the Madrid system and the increased linkages to the global IP system through its ASEAN 2015 commitments, these provisions and others will have to be amended, guaranteeing substantial change to and perhaps upheaval in Indonesia’s trade mark system over the next few years.

Most fundamentally, the law will have to be revised to include non-traditional marks such as three-dimensional marks and sounds marks within the definition of a “mark”, as well as remove the requirement in Articles 7(1) and 12(2) that applications and priority documents are to be submitted in the Indonesian language. The law must also eliminate the mandatory use of IP consultants (proxies) for non-Indonesian applicants as provided for in Article 10.

More substantively, there are at least three additional changes that will have to be made to the trade mark law to bring Indonesia into compliance with its international commitments.

First, both article 6bis of the Paris Convention and article 16(3) of TRIPs require the protection for well-known marks on dissimilar goods. However, the Indonesian Trademark Law only states that an application for a mark should be refused if it has similarity to a well-known mark “for goods and/or services, which are not of the same kind, provided that it fulfils certain conditions that will be regulated further by Government regulation”. Such regulations have never been issued, creating a gap in protection for well-known marks that sometimes allow trade marks to be registered that otherwise should have been rejected based on this international principle. As such, the Trademark Law will have to be revised to articulate the scope of protection for well-known marks on dissimilar goods to close this gap.

Second, both article 10bis of the Paris Convention and TRIPs article 39 require member countries to establish effective laws to address unfair competition. Trademark Law No 15/2001 is entirely silent on this matter, forcing practitioners to rely on non-IP specific provisions found in the Penal Code (article 382bis) and Civil Code (article 1365) that are wholly unsuited to this task.

The last required revision is the most blatant deficiency of those previously mentioned. Article 61(2)(b) of the Indonesian Trademark Law provides that a trade mark registration may be nullified if “the use of [the] mark … is not in accordance with the registered mark”. The Elucidation to the Act specifies: “[t]he unsuitability in the use covers the unsuitability in the form of writing of word or letter or the unsuitability in the use of different color.” This provision clearly contravenes Indonesia’s obligations under article 5(c)(2) of the Paris Convention, which specifically states that the “[u]se of a trademark by the proprietor in a form differing in elements which do not alter the distinctive character of the mark in the form in which it was registered … shall not entail invalidation of the registration and shall not diminish the protection granted to the mark”.

Despite the obvious need to revise Indonesia’s trade mark law to meet its ASEAN 2015 obligations and further integrate itself with the global IP infrastructure, a draft revision was not included on the legislative agenda for 2013. Thus, it would appear that a revised trade mark bill would be considered in 2014 at the earliest. This pushes implementation to 2015 and leaves precious little time to work out any kinks in the system before December 2015, if that deadline is to be met (which remains an open question).

Progress toward ASEAN 2015

Formulated by the ASEAN Working Group on Intellectual Property Cooperation (AWGIPC), the ASEAN Intellectual Property Rights Action Plan 2011-2015 notes the need for member states to participate in global IP systems to boost regional competitiveness. As such, the Action Plan calls on ASEAN member states to accede to three international IP agreements by 2015: the Madrid Protocol, the Patent Cooperation Treaty, and the Hague Agreement, the latter for at least seven member states.

Memberships

[table id=1 /]

*Accession has been approved by the Thai Parliament but formal accession has yet to occur.

Patent capacity needed

The ASEAN IPR Action Plan contains a number of patent-related obligations for implementation by member states as well. For Indonesia, while some of these obligations have already been met, more work remains to be done. The government’s improvements will focus on capacity building and improved public awareness, to make its own efforts more meaningful and give greater effect to the Action Plan’s stated desire to “use IP to jumpstart innovation and encourage technological advances in the region”.

The Action Plan calls for increased participation in “global IP structures, subject to the capacity and readiness of each [member state]”. In the patent field, this manifests itself in the obligation to accede to the Patent Cooperation Treaty by 2015. Indonesia joined the PCT system in 1997 via a presidential decree and the Patent Office began accepting PCT applications the following year. On paper, Indonesia, along with all other ASEAN members except Cambodia and Myanmar, has satisfied its ASEAN 2015 obligations on this point. In 2011, Indonesia had the second highest number of PCT applications in ASEAN for entry into national phase (behind only Singapore), and the highest number since it began accepting applications 15 years ago.

However, the examination process is still quite slow, bogged down by backlog and lack of IT infrastructure at the Patent Office (though implementation of IPAS should help), as well as the underdeveloped capacity of patent examiners and attorneys alike. Applications often only move towards grant once there is a granted patent from a developed country that can be corresponded to the Indonesian application. Even in this situation, the process can take upwards of seven years, despite Patent Law No 14/2001 ostensibly requiring the process to be completed within a maximum of six years. With no such corresponding patent, it is not uncommon for an application to languish in the substantive examination stage for an uncertain number of years.

In an attempt to at least partially address this issue, the Action Plan calls for the implementation of the ASEAN Patent Search and Examination Cooperation (ASPEC) by 2012 and its use for at least 5% of all patent applications filed among member states by 2015. The first regional patent cooperation programme, ASPEC formally commenced in June 2009 and was subsequently revised in April 2012. With the exception of Myanmar, all ASEAN members have joined, with the goal of expediting patent prosecution and boosting efficiency by sharing patent search and examination results. It remains to be seen what impact this initiative will have on the speed, efficiency and accuracy of patent prosecution in Indonesia and the region as a whole, but it could very well be a promising development.

Enforcement needed

Once the examination stage is over and a patent has been granted, there are continuing questions as to the extent of its enforceability in Indonesia. Patent litigation is still quite rare, with only a handful of cases coming before the Commercial Court or the Supreme Court each year. While the Commercial Court should be applauded for its continued improvement in competently handling IP cases, many judges still lack experience trying patent cases or have never been trained in patent law. Advanced scientific or technical backgrounds are even more uncommon.

Even if a party is successful in securing a monetary judgment in a patent case, damages are likely to be low and collection poses its own unique set of problems. Injunctive relief can be difficult to obtain as well. Thus, Indonesia will continue to face challenges in “assuring inventors and innovators that patents granted … [will] have a high presumption of validity and enforceability” as dictated in the Action Plan.

The Action Plan acknowledges many of the problems mentioned above (and others, too) that are experienced by member states, enhancing its status as an honest and realistic document. To wit, Strategic Goals 1 and 5 call for capacity building for patent examiners and professionals, through training, seminars and workshops. The Japanese government and WIPO have been particularly involved in these types of capacity-building activities in Indonesia, conducting numerous programmes with the Indonesian IP Office. Given the complexities of the relevant legal, technological and scientific principles at issue, this understandably continues to be a work-in-progress.

The Action Plan also acknowledges that measures are needed to boost R&D, innovation and access to technology, noting that patent filings by ASEAN nationals have “remained low largely because the capacity for science and technology has not changed much over the last several years”. This is particularly true for Indonesia. Despite having the second highest number of foreign-filed PCT applications in 2011 among ASEAN members, Indonesia was third from the bottom for PCT applications filed by domestic nationals with only eight. The numbers for previous years are similar, demonstrating the more fundamental problem of a weak technological and innovative economic base. General awareness of patents in general is also low, a situation raised by economics professor-cum-Vice-President Boediono on multiple occasions. Indeed, Indonesia has the lowest number of domestic patent applications of any G-20 economy. And while the Indonesian government pays lip service to the need for increased technological innovation, public money that could be used for R&D mostly ends up elsewhere, such as fuel subsidies, which will total more than $20 billion in 2013. It’s clear that to meet the Action Plan’s goal of boosting R&D and innovation in ASEAN’s largest economy, it will take more than treaty membership or workshops. Instead, it will require more abstract but vitally important elements such as political will, something unfortunately in short supply these days.

Getting to work

Despite some progress, clearly much work remains to be done. Whether Indonesia’s efforts in meeting the trade mark- and patent-related strategic goals by the end of 2015 as outlined in the Action Plan will succeed is an open question. What is not in doubt is that a period of great change is on the horizon for south-east Asia’s most active IP jurisdiction and largest economy.

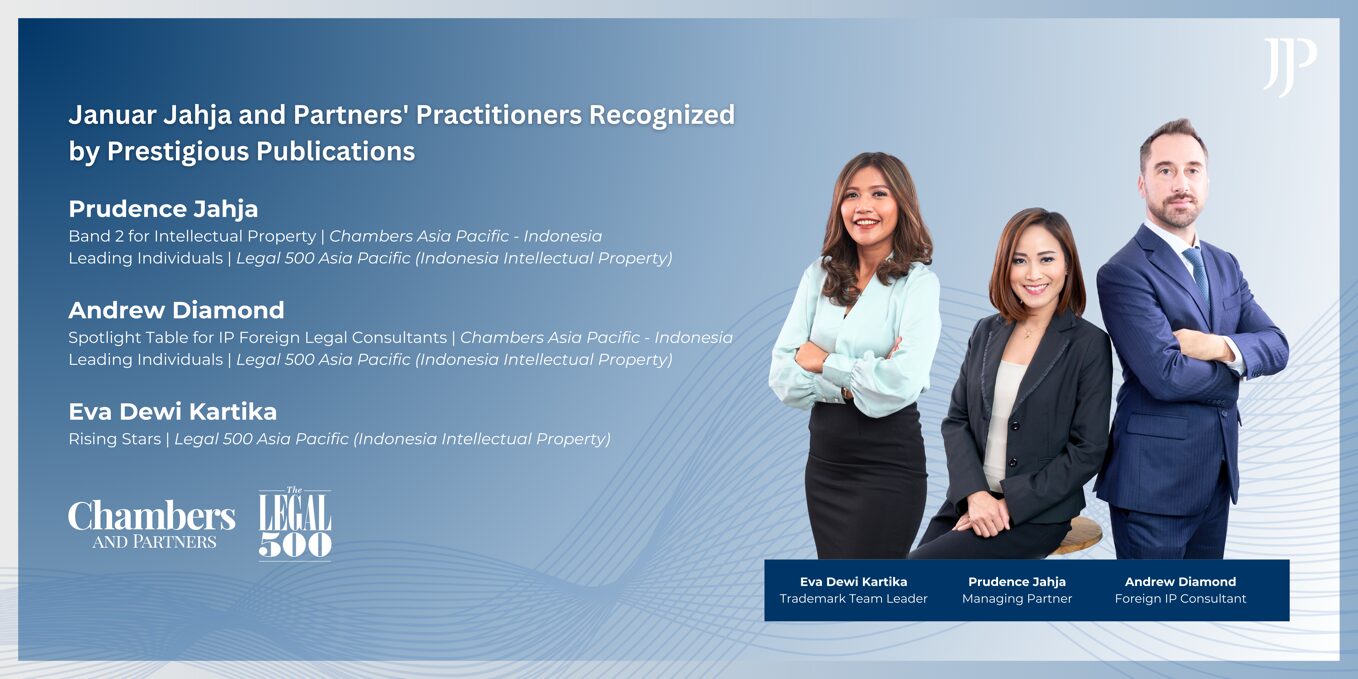

Prudence Jahja

Andrew Diamond

© Prudence Jahja and Andrew Diamond 2013. Jahja is an associate and Diamond is a foreign legal consultant at Januar Jahja & Partners in Jakarta